An enduring commitment to timeless truths in successful leadership and responsible governance — and making the world better with it.

A welcome message from J. Richard Finlay

“Their three outstanding attitudes – obliviousness to the growing disaffection of constituents, primacy of self-aggrandizement, illusion of invulnerable status – are persistent aspects of folly.“

Barbara W. Tuchman, The March of Folly

Sound governance is not some abstract ideal or utopian pipe dream. Nor does it occur by accident or through sudden outbreaks of altruism. It happens when leaders lead with integrity, when directors actually direct and when stakeholders demand the highest level of ethics and accountability.

New legitimizers of public and investor consent

I first began to make the case for these and other enduring truths in leadership and governance more than 40 years ago. I called them the new legitimizers of public consent and predicted they would soon be marching across the world’s boardrooms. Many of us have been hearing those footsteps loud and clear for several years. Now, so have the world’s boardrooms and regulators.

History has convincingly shown their importance, as well as the consequences of their absence. These timeless values of accountability, trust, stewardship and integrity are needed more than ever in a world where society and investors have begun to impose new standards of ethics, environmental disclosure, social responsibility performance and sound governance, just as I predicted they would and argued strongly for as far back as the 1970s.

Stakeholder capitalism: it didn’t just appear out of the blue

Whether this occurs through the lens of ESG, RI or stakeholder capitalism — the term I coined in the 1980s — or through the vision of exceptional directors and CEOs, boardrooms, businesses and investor decisions need to change in fundamental ways.

Continues below…

The Centre for Corporate & Public Governance, now The Finlay Centre for Corporate & Public Governance, has been illuminating the evolution of private enterprise and public trust for more than four decades. It is North America’s first fully independent think tank dedicated to advancing higher standards of ethics, transparency and accountability in major corporations and public institutions and the oldest continuously cited influencer on modern boardroom practices and the attributes of institutional trust. The Centre was founded by J. Richard Finlay, one of the world’s most prescient voices for sound boardroom practices, sanity in CEO pay and the ethical responsibilities of trusted leaders.

Ethics and the unravelling of ESG

Capturing the power of ethics, and understanding the ethics of power, is very much part of the unfinished agenda for 21st century leaders and boards of directors. When I was advancing and promoting the predecessor of ESG, and defining the concept of stakeholder capitalism, I placed considerable emphasis on the role of ethics and the imperative that all organizations that impact society and employ other people’s money operate from a strong culture of integrity.

It’s pretty obvious that the E in ESG today does not stand for ethics. It’s the missing piece in today’s ESG puzzle, which is already hobbled by greenwashing scandals, inconsistent disclosure standards, conflicts among rating agencies and an incomplete understanding by boards. Recent figures show that only 56 companies in the S&P 500 Index disclosed information about their ESG practices. S&P has stopped using a five-point ESG scale for rating funds. BlackRock’s Larry Fink won’t even use the term ESG any longer. Last year, armed police in Frankfurt raided a subsidiary of Deutsche Bank over suspected “greenwashing,” where it was alleged that the bank exaggerated the environmental and climate performance of certain funds it sold.

As I said in the Financial Times recently, ESG is unravelling in a number of ways and it clearly wasn’t ready for prime time. Too many bad actors have become involved. Investor confidence in the concept is cooling. It didn’t need to be this way. ESG was never exposed in its early stages, when getting it right really counted, to the scrutiny of objective experts like FCCPG, which had a long history over several decades thinking, writing and advancing the concept.

Like stakeholder capitalism, which, as the author of that term I know something about, ESG was effectively highjacked by those that saw huge fees in the offing, like rating agencies, and by companies that saw it as yet another door to bigger top management bonuses. It is at about the same state the railway business was in its infancy, where every company had its own gauge of track and nobody could get very far without changing trains. With early adopters like Larry Fink, who has a lot of capital and reputation on the line in supporting ESG as he has, I would have expected better, and more due diligence to get it right. Now, the only hope seems to rest with the intervention of regulators because capitalism could not do the job on its own. What a sad commentary on something so important.

Boards today have their own special earmarks of folly

I have always believed that Barbara Tuchman’s teachings about the hallmarks of folly and the impostors of success were especially germane to the world of business. They have a direct causal connection with the shambolic state of ESG, as noted above. So do a few other guideposts to the misguided I have uncovered over the years, which frequently leave their recognizable fingerprints all over floundering corporate empires, failed political establishments and the reputation of disgraced leaders. I call them the earmarks of boardroom arrogance. They have application to non-corporate actors in government and public institutions as well. Here they are:

1. Blindness to ideas whose time has come – or gone;

2. Defiance of the laws of ethical gravity and a misguided sense of infallibility; and

3. Incuriosity about the world around them.

For boards and CEOs, that last condition (incuriosity) exists because their wealth, position and status insulate them to the point where they just don’t see the need to be curious. And they certainly don’t need to rock the boat when the rules are working so well for them. But others in the organization are often afraid to be curious. It is well recognized that people feel the freedom to innovate only where they know someone has their back and compassion is a governing value. When they don’t see curiosity valued at the top, or in the compensation matrix, they’re not going to stick their neck out. A culture of incuriosity thwarts innovation and deters progress. Most boards and CEOs don’t really understand that connection because, well, they have no curiosity about it. Until the unexpected comes knocking at the boardroom door – as it did for Nortel, Livent, Hollinger, RT Trust, Corel, WorldCom, Lehman Brothers and Bear Sterns, to name a few I have publicly commented on and whose demise I predicted.

The madness of CEO pay

These indicia of folly and arrogance, whether Tuchman’s or Finlay’s, come together in the flashpoint of CEO compensation. I have been writing about this longer than perhaps anyone alive today. Twenty years ago, when I was putting out frequent op-ed columns for the Financial Post and later The Globe and Mail, an editor called it my signature topic because he said so many readers always responded positively to what I had to say about it, and the illuminating detail in which those thoughts were delivered.

It is remarkable in a time when one might think ESG would prompt some long overdue rethinking about titanic-sized increases in CEO pay, all it has done is provide another springboard to even larger bonuses. Some CEOs today are receiving total awards that are thousands of times greater than the median employee salary in their company. Stephen Scherr of Hertz pulled in a total pay package of $182,136,137, which was 4,983 times larger than the company’s median employee. Peloton’s Barry McCarthy was awarded $168,073,420, which was 2,299 times more than the exercise device maker’s median employee was paid. Both these companies have had serious performance problems recently.

I suppose the board at Alphabet, parent of Google, thought these figures made it safe to pay Sundar Pichai a whopping $225,985,000 — let’s just call it a quarter-billion — in 2022. The company’s board cited ESG performance as a contributor to his bonus. Then there are the CEOs of Canadian cannabis chains, who have stumbled into huge pay days as their companies lurch from one disaster to another, without even the flimsiest justification from directors who seem to be missing a few brain cells when it comes to basic corporate governance practice. Talk about smoke and mirrors in the boardroom.

If these elephantine amounts go unabated at a time when, as I said in a recent letter to the Financial Times, the world is focusing like never before on the loss in human capital caused by income disparity, I think we will begin to see another firestorm of discontent and demand for regulatory intervention that is many decibels louder than before. They are an insult to a collective moral conscious and undermine the legitimacy of business. Certainly, they are a drag on morale in the workplace. And yes, as I said in The New York Times not long ago, they make a mockery of any idea of an organization as a team. Sadly, Peter Drucker isn’t with us now to lend his respected voice to this cause. Renowned executive compensation expert Graef “Bud” S. Crystal is no longer around to cast his discerning, evidence-based, gaze on the subject. So it looks like I am left as the last man standing among the long continuing critics of excessive CEO pay, which I once described, and BusinessWeek reported, as “the mad cow disease of the American boardroom.”

An enduring mission…continues

I have been fighting against the attributes of arrogance, complacency and folly in organizations — and for timeless truths in successful leadership and responsible governance — my entire professional life. This has been my defining mission and the catalyst for creating a think tank that would actually think about these issues and raise an informed voice for their advancement. The Centre for Corporate & Public Governance came into being long before any organization aspiring to our role was on the scene. What other independent think tank has contributed more or longer to the evolution of standards in ethical conduct, social purposefulness and sound corporate governance? I think the published record of The Finlay Centre for Corporate & Public Governance, in predicting tectonic boardroom trends and disasters, in presaging the arrival of ESG and RI, in fashioning the founding vision of stakeholder capitalism and unleashing the promise of the well-governed corporation, speaks for itself.

Don’t stop thinking about tomorrow

We’re not about to rest on our past successes. The Finlay Centre’s Lab is working to discover the newest currents that will take major organizations in unexpected directions, just as we have done from our beginning. In addition to our long-standing boardroom practice, The Finlay Centre is increasingly focusing on governance involving public boards, commissions, agencies and human rights commissions. The governance of municipalities, where individuals are often most directly affected by the process of government, is gaining our attention. In the important field of workplace safety and the need to combat gender violence and sexual harassment, The Finlay Centre supports the call for an expanded role for capital market regulators in combating sexual misconduct, as first proposed by Kathleen Finlay and outlined in her letter to the Financial Times.

After four decades, we’re proud to still be illuminating the evolution of private enterprise and public trust.

Welcome to The Finlay Centre for Corporate & Public Governance. Many thanks for visiting, and please drop us a line if you care.

J. Richard Finlay | Founder

Snapshots of thought ~ past and present

New York Times, August 10, 2023

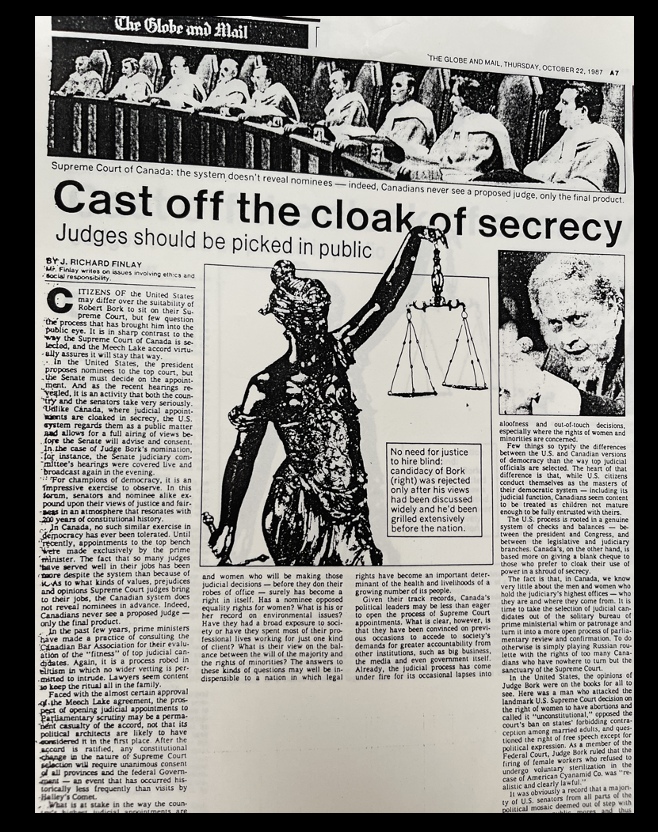

How well did we know former Supreme Court Justice Russell Brown? With his strange conduct and resignation under a cloud, maybe it’s time to look at public vetting of top court nominees — again.

I wrote the first op-ed in The Globe and Mail on that subject in 1987. I suggested then that there should be public hearings of nominees by a committee of MPs and senators. It would put Canada into a more mature place than the antiquated, colonial-style approach of the current system. As I wrote years ago:

Canadians are never afforded an opportunity to know about a nominee’s record and views before he or she sits on the nation’s highest bench. They simply wake up one day and learn about the appointment in the morning newspaper as a fait accompli.

That needs to change.